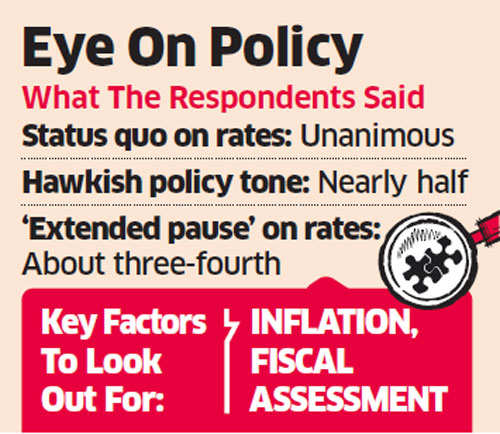

MUMBAI: The Monetary Policy Committee (MPC) will likely vote to keep interest rates unchanged later this week citing inflationary pressure and a recovery in economic growth, according to an ET Poll conducted among 20 market participants.

In RBI’s bi-monthly policy announcement due on December 6, the MPC may also warn of rising prices and adopt a more hawkish tone, which could well be a prelude to a change in stance to tightening from neutral, said a majority of respondents. The MPC will meet on Tuesday and Wednesday.

“Growth concerns are likely to somewhat recede in the coming quarters as the positive impact of reform measures like GST (goods and services tax) will creep in,” said Shubhada Rao, chief economist at Yes Bank. With inflation and fiscal deficit remaining as risks, these factors collectively make a case for status quo while the markets look for the central bank’s assessment in the policy statement. “Room for rate cut is getting squeezed,” she said.

Retail Inflation may go up

India’s gross domestic product expanded 6.3% in the July-September quarter from a year earlier, reversing five quarters of slowing growth and up from a three-year low of 5.7% in the preceding quarter. That comes after disruptions caused by demonetisation in November last year and GST’s rollout on July 1.

“India’s growth is below trend, temporarily disrupted by big-ticket reforms and a weak capex cycle,” said DBS Bank economist Radhika Rao. “The resultant negative output gap has helped contain price pressures, but this is likely to reverse if growth sets into motion next year, as businesses adjust to the new tax regime, (and) the deleveraging process hastens due to bank recap plans. Also, demand recovers, pulling up manufacturing activity alongside.”

Manufacturing activity expanded at its fastest pace in 13 months in November. The Nikkei Indian Manufacturing Purchasing Managers’ Index rose to 52.6 in November compared with 50.3 a month earlier.

“The domestic and global factors which may trigger a rise in inflation might prompt a hawkish response from the MPC, thereby signalling a change in the interest rate cycle,” said Saugata Bhattacharya, chief economist at Axis Bank. “MPC’s communication will be critical in this transition. More than rates, this review will be more about liquidity and transmission. Government’s reform measures are raising India’s potential output.”

The Consumer Price Index (CPI), the retail gauge for inflation, hit a seven-month high, led largely by higher vegetable and fuel prices.

It rose 3.58% in October over the same month last year. It may increase as much as 4.5% by March this fiscal year.

The MPC has maintained a neutral monetary policy stance with the objective of achieving the medium-term CPI target of 4% within a band of 2 percentage points on either side. State Bank of India, the country’s biggest lender, last week raised interest rates by about 100 basis points on bulk deposits.

Since the beginning of October, the benchmark bond yield has risen by about 42 basis points to 7.06%. A basis point is one-hundredth of a percentage point.

Earlier in August, the MPC cut its key policy rate by 25 basis points to 6%, the lowest since November 2010. “RBI’s current neutral stance has an option for rate increase, but nothing would happen immediately, be it change of stance or something else,” said Abheek Barua, chief economist at HDFC Bank. “An extended pause is expected in RBI’s policy action with the central bank anchoring the inflation cautiously.”

Source- ET Realty

In RBI’s bi-monthly policy announcement due on December 6, the MPC may also warn of rising prices and adopt a more hawkish tone, which could well be a prelude to a change in stance to tightening from neutral, said a majority of respondents. The MPC will meet on Tuesday and Wednesday.

“Growth concerns are likely to somewhat recede in the coming quarters as the positive impact of reform measures like GST (goods and services tax) will creep in,” said Shubhada Rao, chief economist at Yes Bank. With inflation and fiscal deficit remaining as risks, these factors collectively make a case for status quo while the markets look for the central bank’s assessment in the policy statement. “Room for rate cut is getting squeezed,” she said.

|

Retail Inflation may go up

India’s gross domestic product expanded 6.3% in the July-September quarter from a year earlier, reversing five quarters of slowing growth and up from a three-year low of 5.7% in the preceding quarter. That comes after disruptions caused by demonetisation in November last year and GST’s rollout on July 1.

“India’s growth is below trend, temporarily disrupted by big-ticket reforms and a weak capex cycle,” said DBS Bank economist Radhika Rao. “The resultant negative output gap has helped contain price pressures, but this is likely to reverse if growth sets into motion next year, as businesses adjust to the new tax regime, (and) the deleveraging process hastens due to bank recap plans. Also, demand recovers, pulling up manufacturing activity alongside.”

Manufacturing activity expanded at its fastest pace in 13 months in November. The Nikkei Indian Manufacturing Purchasing Managers’ Index rose to 52.6 in November compared with 50.3 a month earlier.

“The domestic and global factors which may trigger a rise in inflation might prompt a hawkish response from the MPC, thereby signalling a change in the interest rate cycle,” said Saugata Bhattacharya, chief economist at Axis Bank. “MPC’s communication will be critical in this transition. More than rates, this review will be more about liquidity and transmission. Government’s reform measures are raising India’s potential output.”

The Consumer Price Index (CPI), the retail gauge for inflation, hit a seven-month high, led largely by higher vegetable and fuel prices.

It rose 3.58% in October over the same month last year. It may increase as much as 4.5% by March this fiscal year.

The MPC has maintained a neutral monetary policy stance with the objective of achieving the medium-term CPI target of 4% within a band of 2 percentage points on either side. State Bank of India, the country’s biggest lender, last week raised interest rates by about 100 basis points on bulk deposits.

Since the beginning of October, the benchmark bond yield has risen by about 42 basis points to 7.06%. A basis point is one-hundredth of a percentage point.

Earlier in August, the MPC cut its key policy rate by 25 basis points to 6%, the lowest since November 2010. “RBI’s current neutral stance has an option for rate increase, but nothing would happen immediately, be it change of stance or something else,” said Abheek Barua, chief economist at HDFC Bank. “An extended pause is expected in RBI’s policy action with the central bank anchoring the inflation cautiously.”

Source- ET Realty

No comments:

Post a Comment