MUMBAI: A taxpayer who books an under-construction flat and acquires it within three years of the sale of his old house will be entitled to a tax deduction, the Mumbai bench of the Income-tax Appellate Tribunal (ITAT) has ruled.

“Booking of a flat in an apartment under construction must be viewed as a method of constructing residential tenements,” said the December 18 judgment.

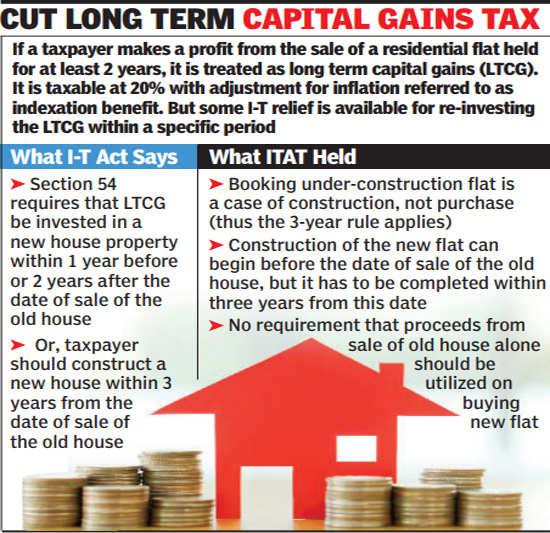

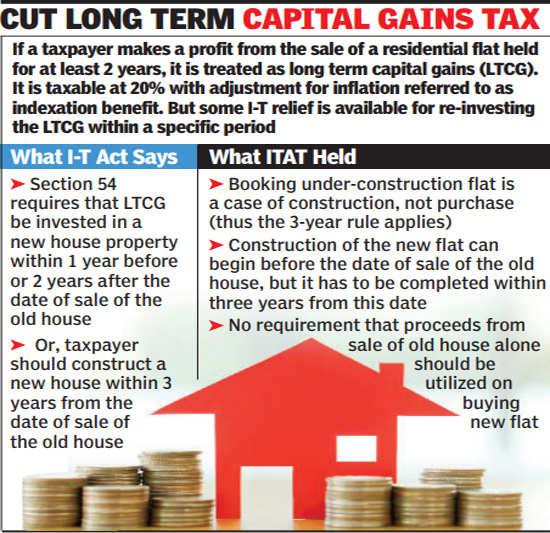

This ruling is important as tax relief on long-term capital gains (LTCG) accrued from sale of a house can be availed only if it is invested in another house within a specified period.

Under section 54 of the I-T Act, the period prescribed for investing the LTCGs in a new house is two years from the date of sale of the old house. The tax benefit is also available if a new residential house is constructed by the taxpayer within three years from the date of sale of the old house.

In this case, the taxpayer invested LTCGs of Rs 78.4 lakh arising from the sale of his share of a Byculla flat into booking a flat in an under-construction building at Mumbai Central. He paid the builder Rs 1.04 crore in instalments prior and post the sale of the old flat.

The final payments were made subsequent to the sale of the old flat. Since the payments exceeded the amount of LTCGs, the taxpayer claimed the entire sum of Rs 78.4 lakh was deductible under section 54. In other words, the taxable component of the LTCGs was ‘nil’.

Since the old flat was sold on December 5, 2012, the taxpayer submitted that the time limit prescribed under section 54 (for constructing a residential house) was available up to December 2015. He pointed out that the new flat was acquired before this date. But the tax authorities treated the booking of a flat as a purchase, which is subject to a two-year limit.

Following earlier decisions of the Bombay high court and the tribunal itself, the ITAT agreed that booking of a new flat in an under-construction apartment should be considered as a case of “construction” and not “purchase”. The ITAT added that the construction can commence prior to the date of sale of the old asset. Earlier, judicial decisions of the Karnataka high court and Ahmedabad ITAT have also held that the date of commencement of the construction is not relevant, and it is only the completion of construction which is relevant for the purpose of section 54.

In this case, the taxpayer had booked the new flat much before the sale of the old flat. However, there was no dispute that he took possession of the new flat within three years of the sale of his old residential flat. Thus, the ITAT held that the time limit prescribed under section 54 had been met.

Lastly, regarding the payments made before the sale of the old flat, the ITAT observed that there is no requirement that the proceeds realised from the sale of the old house alone should be utilized. Thus, the deduction claimed by the taxpayer was allowed in full.

What ITAT said

The ITAT ruled that booking of an under-construction flat is a case of construction and not purchase

Its construction can start before the date of sale of earlier property, but it should be completed within three years from that date to be eligible for tax relief

Source- ET Realty

“Booking of a flat in an apartment under construction must be viewed as a method of constructing residential tenements,” said the December 18 judgment.

This ruling is important as tax relief on long-term capital gains (LTCG) accrued from sale of a house can be availed only if it is invested in another house within a specified period.

Under section 54 of the I-T Act, the period prescribed for investing the LTCGs in a new house is two years from the date of sale of the old house. The tax benefit is also available if a new residential house is constructed by the taxpayer within three years from the date of sale of the old house.

In this case, the taxpayer invested LTCGs of Rs 78.4 lakh arising from the sale of his share of a Byculla flat into booking a flat in an under-construction building at Mumbai Central. He paid the builder Rs 1.04 crore in instalments prior and post the sale of the old flat.

The final payments were made subsequent to the sale of the old flat. Since the payments exceeded the amount of LTCGs, the taxpayer claimed the entire sum of Rs 78.4 lakh was deductible under section 54. In other words, the taxable component of the LTCGs was ‘nil’.

Since the old flat was sold on December 5, 2012, the taxpayer submitted that the time limit prescribed under section 54 (for constructing a residential house) was available up to December 2015. He pointed out that the new flat was acquired before this date. But the tax authorities treated the booking of a flat as a purchase, which is subject to a two-year limit.

Following earlier decisions of the Bombay high court and the tribunal itself, the ITAT agreed that booking of a new flat in an under-construction apartment should be considered as a case of “construction” and not “purchase”. The ITAT added that the construction can commence prior to the date of sale of the old asset. Earlier, judicial decisions of the Karnataka high court and Ahmedabad ITAT have also held that the date of commencement of the construction is not relevant, and it is only the completion of construction which is relevant for the purpose of section 54.

In this case, the taxpayer had booked the new flat much before the sale of the old flat. However, there was no dispute that he took possession of the new flat within three years of the sale of his old residential flat. Thus, the ITAT held that the time limit prescribed under section 54 had been met.

Lastly, regarding the payments made before the sale of the old flat, the ITAT observed that there is no requirement that the proceeds realised from the sale of the old house alone should be utilized. Thus, the deduction claimed by the taxpayer was allowed in full.

What ITAT said

The ITAT ruled that booking of an under-construction flat is a case of construction and not purchase

Its construction can start before the date of sale of earlier property, but it should be completed within three years from that date to be eligible for tax relief

Source- ET Realty

No comments:

Post a Comment