After the recent changes in the Pradhan Mantri Awas Yojana (PMAY), it seems that the interest in the scheme is picking up. Developers have started promoting their offerings in the affordable housing segment, which may sound tempting to those interested in government subsidy.

Real estate has its own share of concerns, both for the end-consumer as well as an investor looking to lock in funds for a quick gain. From a delayed home possession to oversupply of units, there's a lot to tackle in such an illiquid and immovable asset class. PMAY may, however, still generate a positive response, especially if the builders live up to their promise in terms of construction quality and timely delivery. The infrastructure related to affordable housing is also something the government needs to address.

Meanwhile, the subsidy in PMAY is in real rupee terms. Existing guidelines are aimed at the economically weaker section (EWS) and the lower income group (LIG) category, earning Rs 3 lakh and Rs 6 lakh per annum respectively. The two new subsidy slabs (yet to be notified) will bring in people earning up to Rs 12 lakh and Rs 18 lakh per annum into the fold. Irrespective of the loan amount, the subsidy is fixed for each category of income level.

Government subsidy in percentage

The credit-linked subsidy of 6.5 per cent will be available only for loan amounts up to Rs 6 lakh. In the two new slabs, people earning up to Rs 12 lakh per annum will get 4 per cent interest subsidy on a loan amount of Rs 9 lakh, and the Rs 18 lakh per annum income category will get a 3 per cent subsidy on a loan amount of Rs 12 lakh. Any additional loans beyond the subsidised loan amount will be at a nonsubsidised rate. For all the slabs, the scheme will apply to loans with a tenure of up to 20 years.

Government subsidy amount

The interest subsidy amount will not be the differential of interest amount (of actual and subsided rate) but will be the net present value (NPV) of the interest subsidy amount. It is to be calculated at a discount rate of 9 per cent. For calculating NPV of the subsidy, one will need the loan's amortisation schedule as the interest portion of each equated monthly instalment (EMI) has to be considered. Thereafter, use the Fx function in an excel sheet to arrive at the NPV.

Because of the subsidy amount, your loan amount reduces and, therefore, the interest burden too comes down. Let us now see how the interest subsidy amount will be calculated and how it will be applied to one's loan.

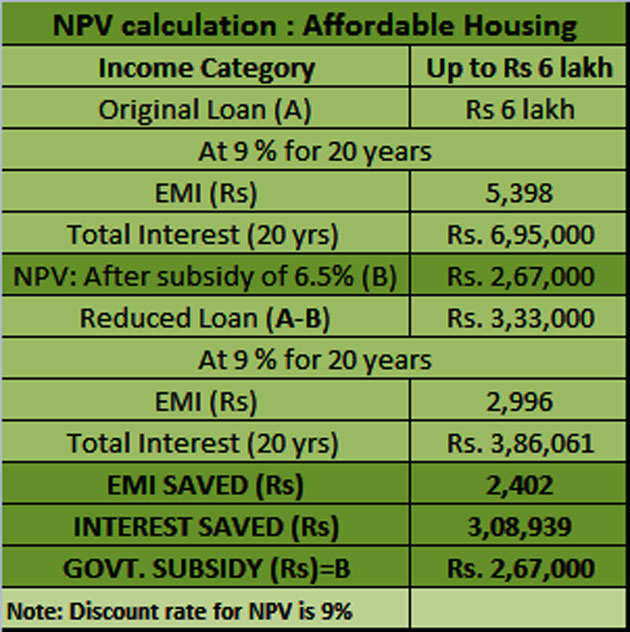

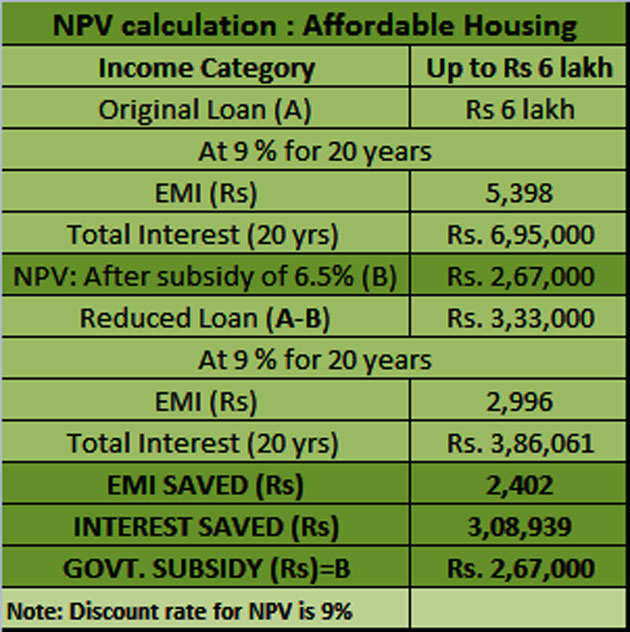

I. First, let's consider someone with an income up to Rs 6 lakh

(Maximum subsidised loan of Rs 6 lakh; Subsidy: 6.5 per cent)

Original loan amount: Rs 6 lakh

Interest rate: 9 per cent

EMI: Rs 5,398

Total interest cost (over 20 years): Rs 6.95 lakh

At 6.5 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2,67,000.

This interest subsidy amount is what the government is offering to the borrowers. So instead of the Rs 6 lakh loan, the revised loan amount comes to Rs 3,33,000. Remember, the borrower has still to service the loan at 9 per cent per annum. This is because the interest subsidy amount will be credited upfront to the borrowers. The net effect: Reduced EMI and a lesser interest burden.

Revised loan amount: Rs 3.33 lakh

Interest rate: 9 per cent

EMI: Rs 2,996

Total interest cost (over 20 years): Rs 3.86 lakh

Net reduction in EMI: Rs 2,402

Net savings in interest: Rs 3, 08,939

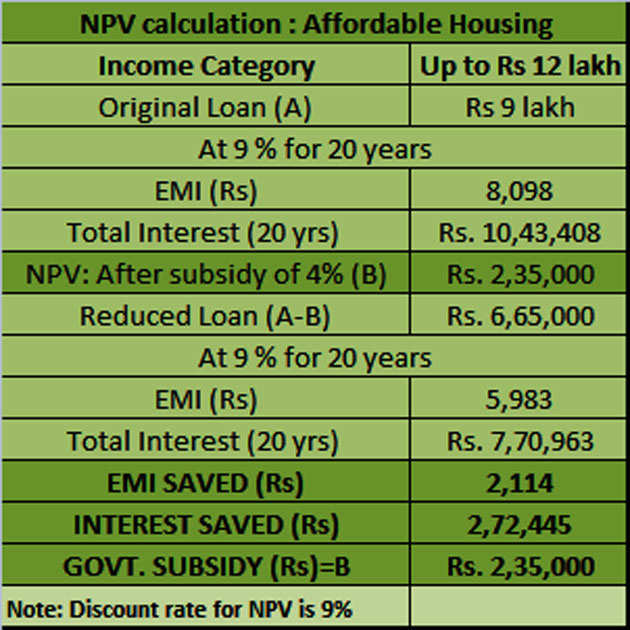

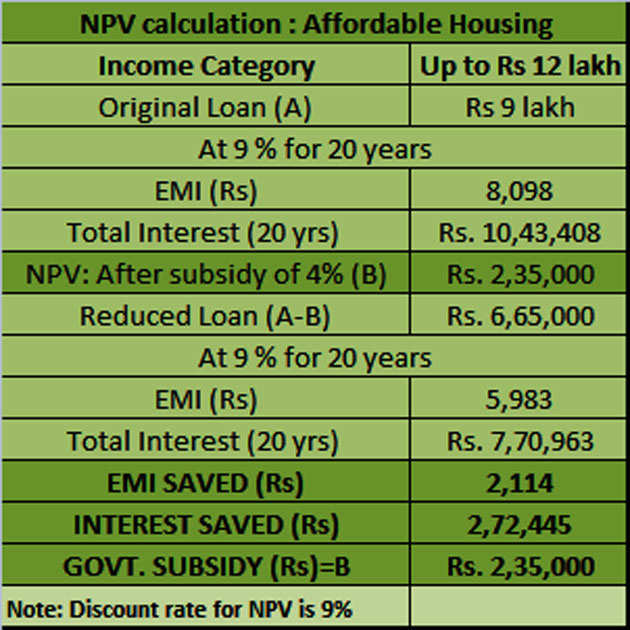

II. Next, let's consider someone with an income up to Rs 12 lakh

(Maximum subsidised loan of Rs 9 lakh; Subsidy: 4 per cent)

Original loan amount: Rs 9 lakh

Interest rate: 9 percent

EMI: Rs 8,098

Total interest cost (over 20 years): Rs 10.43 lakh

At 4 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2, 35,000.

Revised loan amount: Rs 6.65 lakh

Interest rate: 9 per cent

EMI: Rs 5,983

Total interest cost (over 20 years): Rs 7.70 lakh

Net reduction in EMI: Rs 2,114

Net savings in interest: Rs 2, 72,445

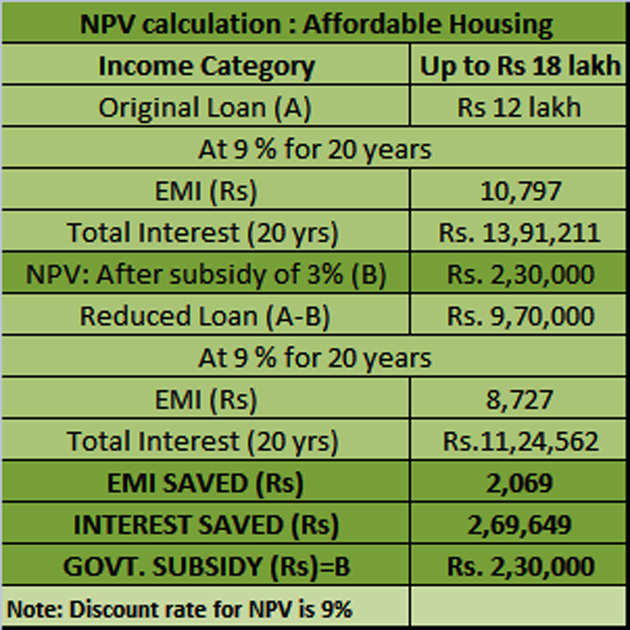

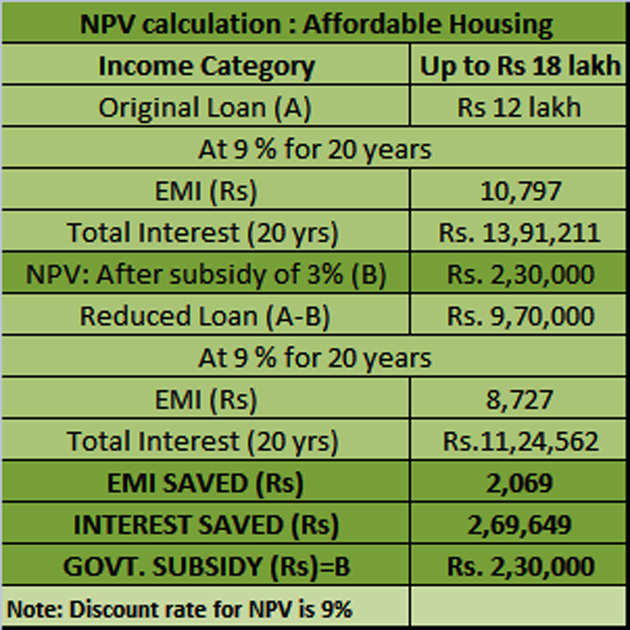

III. Next, let's consider someone with an income up to Rs 18 lakh

(Maximum subsidised loan of Rs 12 lakh; Subsidy: 3 per cent)

Original loan amount: Rs 12 lakh

Interest rate: 9 per cent

EMI: Rs 10,796

Total interest cost (over 20 years): Rs 13.91 lakh

At 3 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2,30,000.

Revised loan amount: Rs 9.7 lakh

Interest rate: 9 per cent

EMI: Rs 8,727

Total interest cost (over 20 years): Rs 11.24 lakh

Net reduction in EMI: Rs 2,069

Net savings in interest: Rs 2, 66,649

Conclusion

The actual interest rate may be different from the 9 per cent considered above. Currently, marginal cost of funds based lending rate (MCLR)-linked home loan rate is hovering around 8.5 per cent, so the EMI will be lower and even the interest savings will be more. But yes, do check out PMAY's eligibility, which is that the person (beneficiary) who applies for the scheme should not own a pucca house (an all-weather dwelling unit) either in his or his family member's name anywhere India. A beneficiary family includes husband, wife and unmarried children.

Source: Et Realty

Real estate has its own share of concerns, both for the end-consumer as well as an investor looking to lock in funds for a quick gain. From a delayed home possession to oversupply of units, there's a lot to tackle in such an illiquid and immovable asset class. PMAY may, however, still generate a positive response, especially if the builders live up to their promise in terms of construction quality and timely delivery. The infrastructure related to affordable housing is also something the government needs to address.

Meanwhile, the subsidy in PMAY is in real rupee terms. Existing guidelines are aimed at the economically weaker section (EWS) and the lower income group (LIG) category, earning Rs 3 lakh and Rs 6 lakh per annum respectively. The two new subsidy slabs (yet to be notified) will bring in people earning up to Rs 12 lakh and Rs 18 lakh per annum into the fold. Irrespective of the loan amount, the subsidy is fixed for each category of income level.

Government subsidy in percentage

The credit-linked subsidy of 6.5 per cent will be available only for loan amounts up to Rs 6 lakh. In the two new slabs, people earning up to Rs 12 lakh per annum will get 4 per cent interest subsidy on a loan amount of Rs 9 lakh, and the Rs 18 lakh per annum income category will get a 3 per cent subsidy on a loan amount of Rs 12 lakh. Any additional loans beyond the subsidised loan amount will be at a nonsubsidised rate. For all the slabs, the scheme will apply to loans with a tenure of up to 20 years.

Government subsidy amount

The interest subsidy amount will not be the differential of interest amount (of actual and subsided rate) but will be the net present value (NPV) of the interest subsidy amount. It is to be calculated at a discount rate of 9 per cent. For calculating NPV of the subsidy, one will need the loan's amortisation schedule as the interest portion of each equated monthly instalment (EMI) has to be considered. Thereafter, use the Fx function in an excel sheet to arrive at the NPV.

Because of the subsidy amount, your loan amount reduces and, therefore, the interest burden too comes down. Let us now see how the interest subsidy amount will be calculated and how it will be applied to one's loan.

I. First, let's consider someone with an income up to Rs 6 lakh

(Maximum subsidised loan of Rs 6 lakh; Subsidy: 6.5 per cent)

Original loan amount: Rs 6 lakh

Interest rate: 9 per cent

EMI: Rs 5,398

Total interest cost (over 20 years): Rs 6.95 lakh

At 6.5 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2,67,000.

This interest subsidy amount is what the government is offering to the borrowers. So instead of the Rs 6 lakh loan, the revised loan amount comes to Rs 3,33,000. Remember, the borrower has still to service the loan at 9 per cent per annum. This is because the interest subsidy amount will be credited upfront to the borrowers. The net effect: Reduced EMI and a lesser interest burden.

Revised loan amount: Rs 3.33 lakh

Interest rate: 9 per cent

EMI: Rs 2,996

Total interest cost (over 20 years): Rs 3.86 lakh

Net reduction in EMI: Rs 2,402

Net savings in interest: Rs 3, 08,939

II. Next, let's consider someone with an income up to Rs 12 lakh

(Maximum subsidised loan of Rs 9 lakh; Subsidy: 4 per cent)

Original loan amount: Rs 9 lakh

Interest rate: 9 percent

EMI: Rs 8,098

Total interest cost (over 20 years): Rs 10.43 lakh

At 4 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2, 35,000.

Revised loan amount: Rs 6.65 lakh

Interest rate: 9 per cent

EMI: Rs 5,983

Total interest cost (over 20 years): Rs 7.70 lakh

Net reduction in EMI: Rs 2,114

Net savings in interest: Rs 2, 72,445

III. Next, let's consider someone with an income up to Rs 18 lakh

(Maximum subsidised loan of Rs 12 lakh; Subsidy: 3 per cent)

Original loan amount: Rs 12 lakh

Interest rate: 9 per cent

EMI: Rs 10,796

Total interest cost (over 20 years): Rs 13.91 lakh

At 3 per cent (subsidy), the NPV of the interest subsidy amount comes to Rs 2,30,000.

Revised loan amount: Rs 9.7 lakh

Interest rate: 9 per cent

EMI: Rs 8,727

Total interest cost (over 20 years): Rs 11.24 lakh

Net reduction in EMI: Rs 2,069

Net savings in interest: Rs 2, 66,649

Conclusion

The actual interest rate may be different from the 9 per cent considered above. Currently, marginal cost of funds based lending rate (MCLR)-linked home loan rate is hovering around 8.5 per cent, so the EMI will be lower and even the interest savings will be more. But yes, do check out PMAY's eligibility, which is that the person (beneficiary) who applies for the scheme should not own a pucca house (an all-weather dwelling unit) either in his or his family member's name anywhere India. A beneficiary family includes husband, wife and unmarried children.

Source: Et Realty

No comments:

Post a Comment